What Is A BACS Payment? The Essentials You Should Know

Bankers’ Automated Clearing Services (BACS) is one of the most widely used methods for the purpose of making electronic payments directly between banks in the UK. Whether you want to make a salary transfer, supplier payment, or HMRC tax remittance, BACS stands as a vital mechanism to facilitate smooth, efficient, and secure transactions. BACS was introduced in 1968, and it has unarguably evolved into the backbone of UK financial operations since then. Moreover, the BACS system is pivotal to payroll and business operations. Hence, it is imperative for employers to understand what is BACS payment and how it affects their business to maintain compliance with HMRC alongside optimally managing employee transactions. Therefore, if you were looking for an all-inclusive source to learn about what is a BACS payment system, you have landed on the right page. This blog is meant to provide you with a detailed insight into what is a BACS payment system, how BACS works, and how to ensure HMRC compliance with BACS.

What Is A BACS Payment?

BACS stands for Bankers’ Automated Clearing System. For your ease of understanding, it is a network of banks to ensure direct electronic payments between them. Alternatively, the BACS is a payment service that facilitates electronic transfers between accounts, such as making a bank transfer from one bank account to another. Notably, BACS payment is a secure and reliable way of transferring money between banks. In addition, BACS is not only one of the most popular payment methods in the UK, but it is also a regulated payment system, which is now operated by BACS Payment Schemes Limited. More importantly, it is among the most frequently used methods for sending and receiving money between banks.

Further elaborating, consider a scenario wherein you pay your household bills or use a subscription service. For these purposes, you will have to make electronic payments through BACS first.

Understanding Types Of BACS Payments:

There are primarily two types of BACS transactions, knowing which is significant when learning what is a BACS payment. To clarify, you can make a BACS payment either through direct debit or direct credit:

Direct Debit:

This type of BACS payment allows an organisation to collect money from a customer’s account with prior authorisation. For instance, with direct debit, an employee gives explicit permission to a company to withdraw payments from their account automatically on an agreed-upon schedule, like every month. It’s commonly used for recurring bills like utilities, subscriptions, council tax, or loan repayments.

Direct Credit:

When a payment is made into your account through a third party, it is said to have been done via direct credit. To explain, direct credit is used to send money directly into a recipient’s bank account and is the preferred method for employers to pay employee wages, pensions, or supplier invoices. It is worth highlighting here that In the context of payroll, BACS Direct Credit is the primary tool employers use to process salary payments.

How Long Does a BACS Payment Take?

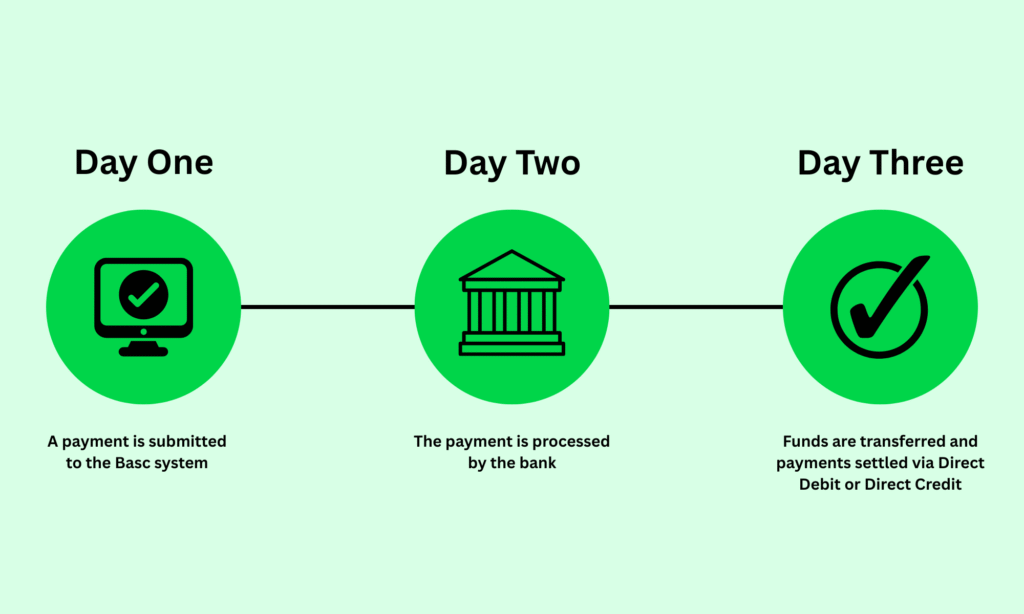

Primarily, BACS payments are processed in a three-day cycle, as a BACS payment takes three business days to clear. Let’s dissect this process:

- On day 1, the payment file is submitted to the BACS system.

- On day 2, the bank processes the file and clears it.

- Finally, on day 3, funds are transferred and appear in the recipient’s bank account, i.e. payment is credited to the recipient’s account. In addition, Direct Credit or Direct Debit are used to settle payments and transfer funds.

The three-day cycle of BACS payment is depicted in the image below:

Furthermore, the BACS payment file submitted on Monday will be cleared by the bank on Wednesday. Likewise, if the payment file is submitted on Friday, it will be cleared on Tuesday since weekends and bank holidays are excluded.

Ultimately, this three-day cycle signifies that BACS is not an instant payment method. Accordingly, it is necessary for employers to account for this delay when scheduling payroll to ensure employees are paid on time.

How To Make A BACS Payment?

Learning how to make BACS payments is a vital part of understanding what is a BACS payment. You can make a BACS payment via Direct Debit or Direct Credit. We will go through each. To make a BACS payment, you will usually need the other party’s name, bank details, account number and sort code. Apart from that, you must also know the same details from which you are withdrawing.

How To Make A BACS Payment Via Direct Debit?

For those who are HSBC customers, the following steps indicate how to make a BACS payment through Direct Debit:

Submit Your Details:

First, you need to have your name, address, account number, sort code, and the name and address of your bank.

Make A Direct Debit Request

Next, you can make a request for a Direct Debit either online or over the phone. As a substitute, you can also request an in-person form from the company.

Complete The Setup:

Finally, you will decide on a date when payments will be taken. Significantly, unless you cancel the Direct Debit, payments continue to be made on the scheduled date.

To add to your information, HSBC is a global banking and financial services organisation which offers a wide range of banking products and services to meet a diverse range of clients. Its services include retail banking, wealth management, and business banking.

How Does Direct Credit Payment Work?

Similarly, to receive payment via Direct Credit, you will provide the payer with your sort code and account number. You should get paid automatically once:

- The payer has approved the payment, and it has been initiated.

- It has been processed by the sending bank.

If a BACS payment is not received, check with the payer and confirm the payment details are accurate. Lastly, it is suggested you check with the payer to ensure the payment details are correct if you do not receive a BACS payment.

Who Can Use BACS?

Knowing who can benefit from BACS is another significant facet of learning what is a BACS payment. Primarily,

- Businesses use BACS to pay employee salaries, suppliers, and HMRC liabilities. It is relevant to note that a business must be registered with BACS-approved software and a Service User Number (SUN) to use BACS directly. Nevertheless, for small businesses, using BACS-approved payroll accountants can make it more accessible without bearing the administrative burden.

- Employers use BACS to fulfil their PAYE liabilities, NICs, and CIS deductions to HMRC. To make things easier, HMRC provides BACS details on its website for tax payment submissions. Therefore, employers must include their Accounts Office reference for correct allocation, since submitting incorrect BACS payments to HMRC can result in penalties from HMRC. Thus, employers should verify or recheck their reference numbers and payment details before making submissions to stay on the safe side.

- Government departments and large organisations use BACS for bulk payment processing.

- Banks and payroll service providers use BACS as part and parcel of their automated services.

You can gain a profound understanding of PAYE and CIS deductions by reading our following guides, respectively:

- What is PAYE and why is it important?

- How to calculate pay-as-you-earn tax (PAYE)?

- A Guide To What is The Construction Industry Scheme (CIS)?

- How to register for CIS in the UK?

What Are The Benefits Of BACS Payments?

After gaining a thorough understanding of what is a BACS payment, it is no less significant to shine light on its benefits:

Cost-Effective:

BACS payments typically cost less than other methods, such as CHAPS. Some banks offer BACS payments at minimal fees, making it ideal for high-volume transactions like payroll.

Secure:

BACS is operated by Pay. The UK is heavily regulated to prevent any possibility of fraud and errors. Are you musing on what Pay UK is? It is the recognised operator and standards body for the UK’s interbank payment systems. Its paramount responsibility is to provide the digital networks that enable secure and efficient payments for banks, building societies, payment providers, and their customers. More importantly, Pay. The UK ensures that payments like BACS, Faster Payments, and cheques can flow smoothly.

Efficient:

Businesses can easily schedule their payments in advance. Subsequently, it greatly helps businesses manage cash flow and employee expectations.

Trackable:

Another substantial benefit of BACS payment is that electronic records provide transparency and audit records for compliance purposes.

Wide Adoption:

Since nearly all UK banks support BACS, it is universally accessible.

Conclusion:

In essence, understanding the fundamentals of what is a BACS payment is utterly crucial since it remains one of the most reliable and cost-effective ways to manage payroll and supplier payments in the UK. Although it does not offer the instant speed of Faster Payments, its affordability and security make it an immensely favourable option for businesses that process bulk or massive transactions like monthly salaries. Beyond that, an employer must understand how BACS fits into their organisation’s payroll, and also ensure HMRC compliance to avert payment delays or reporting issues. However, relying on a payroll expert can tremendously help a business avoid the technical complications of payroll processing. To your relief, the certified and proficient payroll accountants at Payroll Services Accountants can help you manage your BACS payments seamlessly, handle RTI submissions, and stay compliant with HMRC’s evolving regulations.

Further down the line, you will no longer have to waste your breath on ensuring your employees are paid accurately and on time. Thus, whether you are a small business owner or a steadily growing enterprise, outsourcing your payroll to our skilled accountants will ensure effective and efficient payroll management.

Disclaimer: The content contained in this blog is exclusively aimed at informational purposes and should be treated as such. While it has been written with thorough scrutiny at the time of writing to ensure all information is correct, no warranty for the acceptance of any error or inaccuracy is given. It is not a piece of absolute financial advice, nor is it expert legal advice. Hence, it is advised to consult a professional before acting upon any information stated herein.